MCC Quant Research #EPD

- 17 hours ago

- 3 min read

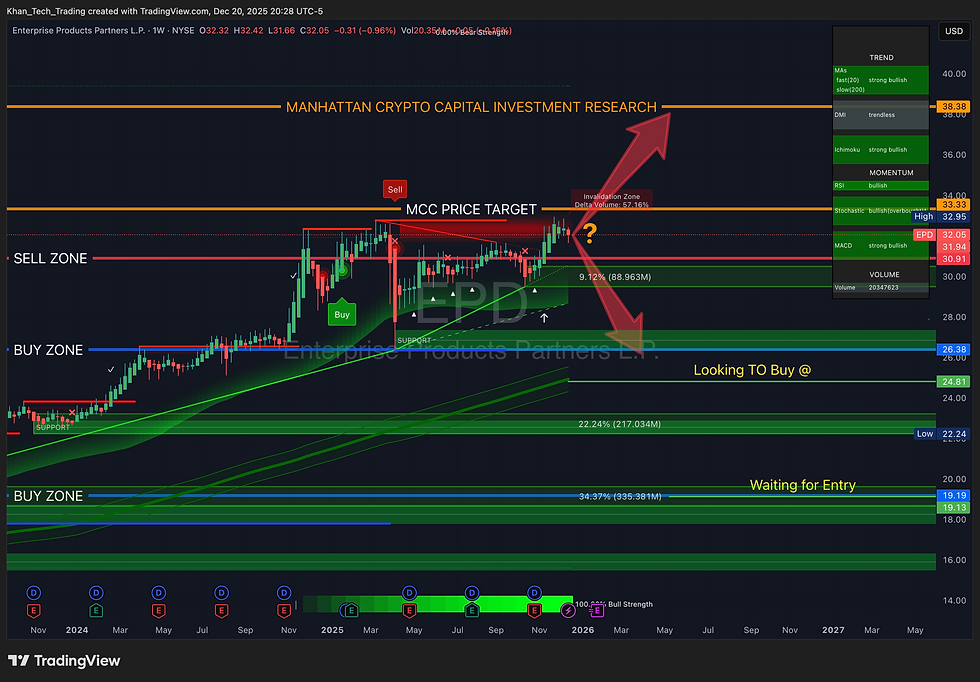

MCC Quant Research EPD

Enterprise Products Partners L.P. (NYSE: EPD)

Asset: Enterprise Products Partners L.P.

Timeframe: Weekly (Primary)

Vehicle Role: Defensive Income / Energy Infrastructure

Fund Mandate: Long-only, cash-yielding compounder with cycle-aware rotation

Issue: December 19, 2025

1. Market Regime & Quant Score

Weighted Quant Components (Weekly):

MAs alignment: 78%

Price remains above rising long-term moving averages but is extended from the mean, increasing the risk of reversion.

DMI trend strength: 65%

Trend remains intact; directional momentum has weakened following rejection near upper resistance.

Ichimoku cloud positioning: 71%

Price is above the cloud, but the forward cloud is flattening, signaling late-cycle conditions.

Momentum (MACD / Stochastic): 69%

Momentum remains positive but stretched; stochastic indicates overbought conditions.

Structure & trend integrity: 74%

Long-term higher-highs and higher-lows remain intact; consolidation risk is elevated.

Volume/distribution: 70%

Light distribution visible near the sell zone; no aggressive institutional exit detected.

RSI offset (overbought penalty): -8%

Market Regime: Late-cycle bullish within a primary secular uptrend

Total Quant Regime Score: 74 / 100

Interpretation: EPD remains structurally bullish but operates in a late-cycle regime characterized by elevated price extension, moderating momentum, and increasing distribution risk. Asymmetry favors patience rather than fresh deployment at current levels.

2. MCC Portfolio Context

EPD functions as a core defensive income asset within the Private Credit Engine.

Role inside MCC: Yield engine + volatility dampener

Volatility behavior: Low to moderate relative to equities and crypto

Yield profile: Approximately 6.8–7.0% annual distribution yield

Yield mechanics: All distributions drip into MCC cash reserves and are recycled into higher-asymmetry opportunities across crypto, equities, and gold

Portfolio interaction: Stabilizes portfolio cash flow while funding rotation during risk-off periods

EPD is treated as a cash-flow asset, not a growth equity.

3. BUY SCENARIO — Long-Only Accumulation

Buy Zone 1 (Fair Value): $26.50 – $25.75

Near intrinsic value and rising structural support

Acquisition Quality Score: 78 / 100

MCC Action: Staged accumulation only after stabilization

Buy Zone 2 (Margin of Safety): $23.50 – $22.75

Discount to intrinsic value with rising fear

Acquisition Quality Score: 88 / 100

MCC Action: Defensive accumulation using recycled yield

Buy Zone 3 (Deep Value / Crisis): $20.00 – $19.00

Extreme fear / forced liquidation scenario

Acquisition Quality Score: 95 / 100

MCC Action: High-conviction capital deployment

Example Allocation ($1,000 notional):

Zone | Allocation | Entry Range | Rationale |

Primary | $400 | $26.50–25.75 | Fair value support |

Secondary | $350 | $23.50–22.75 | Margin of safety |

Deep | $250 | $20.00–19.00 | Extreme fear |

4. SELL / RISK-OFF SCENARIO (NO SHORTS)

Sell Zone 1: $32.00 – $33.00

Trading materially above intrinsic value

Yield compression risk elevated

MCC Action: Trim excess exposure; rotate into cash or private credit

Sell Zone 2: Above $36.00

Euphoria / yield-chasing behavior

MCC Action: Aggressive de-risking; preserve core only

Capital rotated from trims flows into:

Cash reserve

Gold hedge

Crypto fear zones

Equity drawdowns

5. Cycle-Based ROI Bands

(Excludes dividend yield, which materially improves total return)

Cycle Phase | Target Range | Estimated ROI |

Bear / Sideways | $22–30 | -15% to +15% |

Base Case | $32–33 | +22% to +26% |

Bull Extension | $36+ | +38%+ |

6. Risk Profile

Volatility: Low–Moderate

Drawdown Risk: ~20–30% in regular cycles

Trend Strength: Strong

Success Probability: ~70–75%

Total Risk Score: 84 / 100

A higher score reflects durable cash flow, exposure to essential infrastructure, and downside protection through yield.

Hard invalidation: Weekly structural failure below ~$19.

7. MCC Quant Rules Applied

Buy below intrinsic value, not yield headlines

Treat EPD as a cash-flow equity, not a momentum trade

Accumulate only when fear exceeds greed

Trim when price trades materially above fair value

Recycle yield into a cash reserve continuously

Rotate excess gains into private credit, gold, or crypto fear zones

Maintain long-only discipline with capital preservation priority

8. Strategic Interpretation (MCC Risk Mandate)

Current stance: Trim-biased; price extended above intrinsic value

If price pulls back to Buy Zone 1: Begin measured accumulation

If price enters Buy Zone 2: Increase deployment materially

If price accelerates higher: Continue trimming; no chasing

No forecasts. Execution is strictly conditional.

9. One-Liner

MCC long-only view on #EPD: late-cycle bullish structure with elevated greed favors disciplined trimming above intrinsic value and accumulation only on fear-driven pullbacks, supported by an 84/100 risk score.

LEGAL DISCLAIMER: This content is quantitative research and technical analysis for educational purposes only and does not constitute financial advice, investment recommendations, or solicitation to trade. Investing involves risk, including loss of capital. Past performance does not guarantee future results. Always conduct your own research and consult a licensed financial professional before making investment decisions.

Comments